7 Essential Tips for Sourcing the Best Silicon Carbide Bushing Globally

Table of Contents

- Understanding the Importance of Silicon Carbide Bushings in Today's Market

- Identifying Key Manufacturers for Quality Silicon Carbide Bushings

- Comparing Global Suppliers: What to Look For in Silicon Carbide Products

- Evaluating Cost vs. Quality: Making Informed Sourcing Decisions

- Navigating Import Regulations: Tips for Sourcing Silicon Carbide Bushings Globally

- FAQS

- Related Posts

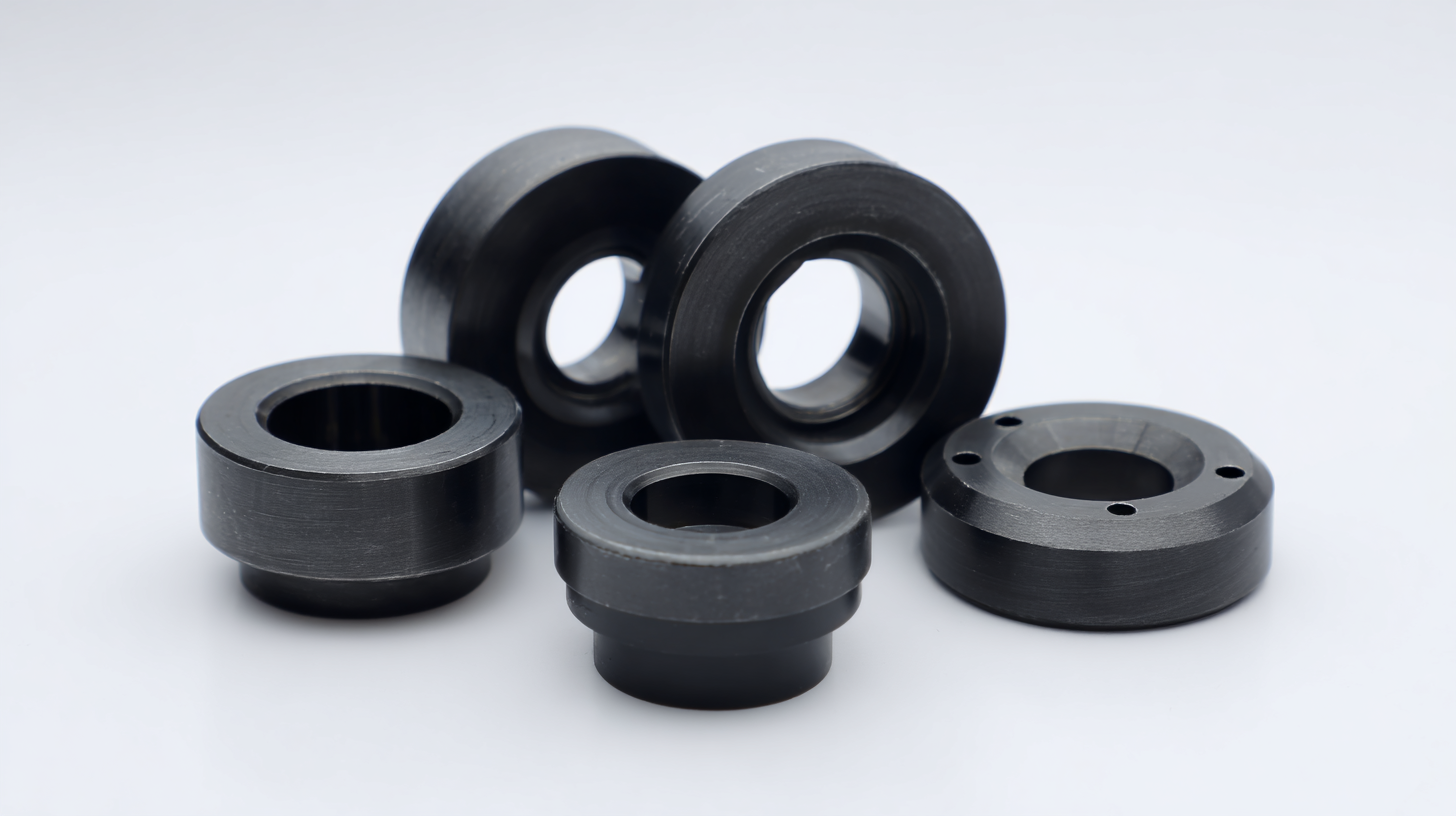

In the rapidly evolving world of precision ceramics, sourcing high-quality Silicon Carbide Bushings has become a pivotal aspect for industries relying on advanced materials for improved performance and durability. According to a recent market report by ResearchAndMarkets, the global silicon carbide market is projected to grow at a CAGR of 16.8% through 2027, underscoring the increasing demand for materials that withstand extreme conditions.

St.Cera Co., Ltd., a private high-tech enterprise specializing in precision ceramic manufacturing, is at the forefront of this innovation, backed by a team of leading experts and engineers. As we navigate the complexities of sourcing these critical components globally, understanding the key factors to consider will not only enhance selection but also ensure the integration of superior Silicon Carbide Bushings into your applications, unlocking new potential in performance and reliability.

Understanding the Importance of Silicon Carbide Bushings in Today's Market

Silicon carbide (SiC) bushings are becoming increasingly vital in today's high-performance applications, driven by the relentless push toward more efficient and powerful technologies. As the market evolves, the demand for SiC is expected to surge, particularly due to the automotive industry's shift toward 800V systems. This transition not only enhances charging speed and energy efficiency in battery electric vehicles (BEVs) but also intensifies the pressure on suppliers to deliver robust and reliable SiC components.

Recent industry reports indicate that the global market for silicon carbide is projected to grow at a CAGR of over 20% through the next five years, fueled by advancements in sectors such as renewable energy, power electronics, and electric mobility. Specifically, the fragmentation in the semiconductor industry and the increasing reliance on SiC for various applications underline the importance of sourcing high-quality silicon carbide bushings. Companies looking to capitalize on this growth must prioritize strategic partnerships with reputable suppliers, ensuring access to the latest innovations and materials that can meet the industry's stringent performance requirements.

Identifying Key Manufacturers for Quality Silicon Carbide Bushings

When sourcing high-quality silicon carbide bushings, identifying key manufacturers is pivotal to ensuring product excellence. According to a report by MarketsandMarkets, the global silicon carbide market is projected to reach USD 5.8 billion by 2026, reflecting a compound annual growth rate (CAGR) of 16.8% from 2021 to 2026. This growth is driven by the increasing demand for durable, wear-resistant materials in industries such as automotive, aerospace, and electronics. Focusing on reputable manufacturers with a strong track record in silicon carbide production can provide a competitive edge for businesses looking to enhance their operational efficiency and product reliability.

One critical factor in selecting manufacturers is their adherence to industry standards and certifications. ISO 9001 certification, for example, ensures that a manufacturer consistently provides products that meet customer and regulatory requirements. Additionally, the availability of third-party evaluations and case studies can further validate a manufacturer's reputation. According to the Silicon Carbide Manufacturers Consortium, companies that prioritize quality assurance and invest in cutting-edge fabrication technologies often deliver superior silicon carbide products. By leveraging these insights and focusing on established manufacturers, businesses can secure high-performance bushings tailored to their specific applications.

Comparing Global Suppliers: What to Look For in Silicon Carbide Products

In the rapidly evolving global silicon carbide (SiC) market, the competition among manufacturers has intensified, particularly regarding 8-inch wafers, which are becoming increasingly critical for advanced power electronics. As reported, the SiC-based power electronics and inverter market was valued at approximately USD 663.1 million in 2021 and is projected to expand significantly to nearly USD 9 billion by 2028, showcasing a 31% increase from 2022. This surge is driven by the rising demand for efficient energy solutions and the transition to 800V systems, prompting key players to ramp up production capabilities.

The strategic initiatives taken by industry leaders reflect the urgency to meet this growing demand. For instance, one manufacturer has inaugurated the world's largest SiC power semiconductor plant, aiming to fortify its position in this competitive landscape. Additionally, a major supply agreement has been established, illustrating the commitment to secure a steady flow of 150mm silicon carbide wafers through 2025. With the projected market for silicon carbide semiconductor devices expected to reach USD 10.39 billion by 2030, it is clear that suppliers must focus not only on technological advancements but also on building resilient partnerships to thrive in this burgeoning sector.

Evaluating Cost vs. Quality: Making Informed Sourcing Decisions

When sourcing silicon carbide bushings globally, a critical factor to consider is the balance between cost and quality. It's essential to conduct a thorough cost-benefit analysis to determine not only the immediate financial impact but also the long-term benefits that high-quality components can provide. For instance, research has shown that investing in superior materials can reduce maintenance costs and downtime, ultimately leading to higher productivity.

One of the main tips for sourcing effectively is to evaluate suppliers based on their track record and quality management processes. Implementing Total Quality Management (TQM) principals ensures that every stage of the production process adheres to quality standards, thereby minimizing defects. Moreover, collaborating with suppliers who can provide detailed analytics about their manufacturing processes can help in making informed decisions.

Another crucial tip is to consider the total lifecycle costs associated with the silicon carbide bushings. Besides the initial purchase price, factors such as energy efficiency and the environmental impact during production play significant roles in the overall cost-effectiveness. A recent study highlighted that organizations adopting advanced analytics for decision-making witnessed substantial improvements in operational efficiency, reinforcing the importance of informed sourcing strategies.

Navigating Import Regulations: Tips for Sourcing Silicon Carbide Bushings Globally

When sourcing silicon carbide bushings globally, navigating import regulations is paramount for efficiency and compliance. Many manufacturers, including precision ceramic specialists like ST.CERA CO., LTD., need to understand the specific requirements imposed by different countries. For instance, the World Trade Organization reports that about 60% of export-import complications arise from non-adherence to local regulations, underscoring the importance of thorough documentation and compliance management. It's essential for companies to stay updated on tariffs, quotas, and standards set by organizations such as ASTM International, which can vary significantly across regions.

Furthermore, understanding the supply chain dynamics is crucial in sourcing silicon carbide bushings. Recent market research indicates that the demand for silicon carbide products is expected to grow at a CAGR of 16% through 2025, driven by advancements in industries such as aerospace and automotive. This surge not only emphasizes the need for quality precision ceramic parts but also highlights the competition among suppliers. Companies like ST.CERA CO., LTD. can leverage their expertise in R&D and manufacturing to ensure that they meet these rising demands while complying with the intricate web of international regulations. Engaging with local experts and utilizing platforms that provide insights on market trends can streamline the sourcing process significantly.

FAQS

: The global silicon carbide market is projected to reach USD 5.8 billion by 2026, with a compound annual growth rate (CAGR) of 16.8% from 2021 to 2026.

Choosing reputable manufacturers is critical for ensuring product excellence and enhancing operational efficiency and product reliability.

ISO 9001 certification is essential as it ensures that manufacturers consistently provide products that meet customer and regulatory requirements.

The SiC-based power electronics and inverter market was valued at approximately USD 663.1 million in 2021 and is projected to expand to nearly USD 9 billion by 2028, showcasing a notable increase driven by rising demand for efficient energy solutions.

Businesses should conduct a thorough cost-benefit analysis, considering long-term benefits such as reduced maintenance costs and downtime against immediate financial impacts.

TQM is an approach that ensures every stage of the production process adheres to quality standards, thereby minimizing defects and enhancing the overall quality of the products sourced.

Advanced analytics can provide organizations with detailed insights into manufacturing processes, leading to informed sourcing strategies and substantial improvements in operational efficiency.

Total lifecycle costs include not only the initial purchase price but also factors like energy efficiency and the environmental impact during production.

Key players are ramping up production capabilities, including opening the world's largest SiC power semiconductor plant and establishing long-term supply agreements for silicon carbide wafers.

Investing in high-quality materials can lead to reduced maintenance costs and downtime, ultimately resulting in higher productivity and better overall performance.

Related Posts

-

How to Choose the Best Silicon Carbide Plates for Your Industrial Needs

-

Navigating Global Trade Certifications for Best Al2o3 Ceramic Rod Purchases

-

How to Choose the Best ESD Wafer Arm for Optimal Semiconductor Processing Efficiency

-

2025 Trends in Advanced Ceramics: Innovative Solutions for Best Sic Ceramic Fork Applications

-

How to Choose the Best Sapphire Tube: Essential Metrics and Industry Insights for Global Buyers

-

Ultimate Guide to Sourcing the Best Ceramic C-Shape Rings for Global Markets

Blog Tags: